The first edition of the Business Barometer: Kenya CEO Survey by the global publishing, research and consultancy firm Oxford Business Group (OBG) was launched in partnership with Kenya Investment Authority (Keninvest) yesterday.

Taking place under the banner “Facts and Numbers”, the event provided a platform for OBG’s team to share its findings with an audience of dignitaries, VIPs, representatives from the public and private sectors, and members of the media.

Monica Juma, cabinet secretary, Ministry of Foreign Affairs and International Trade, gave a keynote speech, after which Souhir Mzali, OBG’s regional editor for Africa, presented the results of the survey.

Juma also took part in a panel discussion at the event, which was moderated by Laban-Cliff Onserio, Nation Media Group. Other panelists included: Nick Nesbitt, chairman, Kenya Private Sector Alliance; Vimal Shah, chairman, Bidco; Corine Mbiaketcha Nana, managing director, Oracle Kenya; and Jeremy Awori, managing director, Barclays.

As part of its survey, OBG asked over 100C-suite executives from across Kenya’s industries a wide-ranging series of questions on a face-to-face basis aimed at gauging business sentiment.

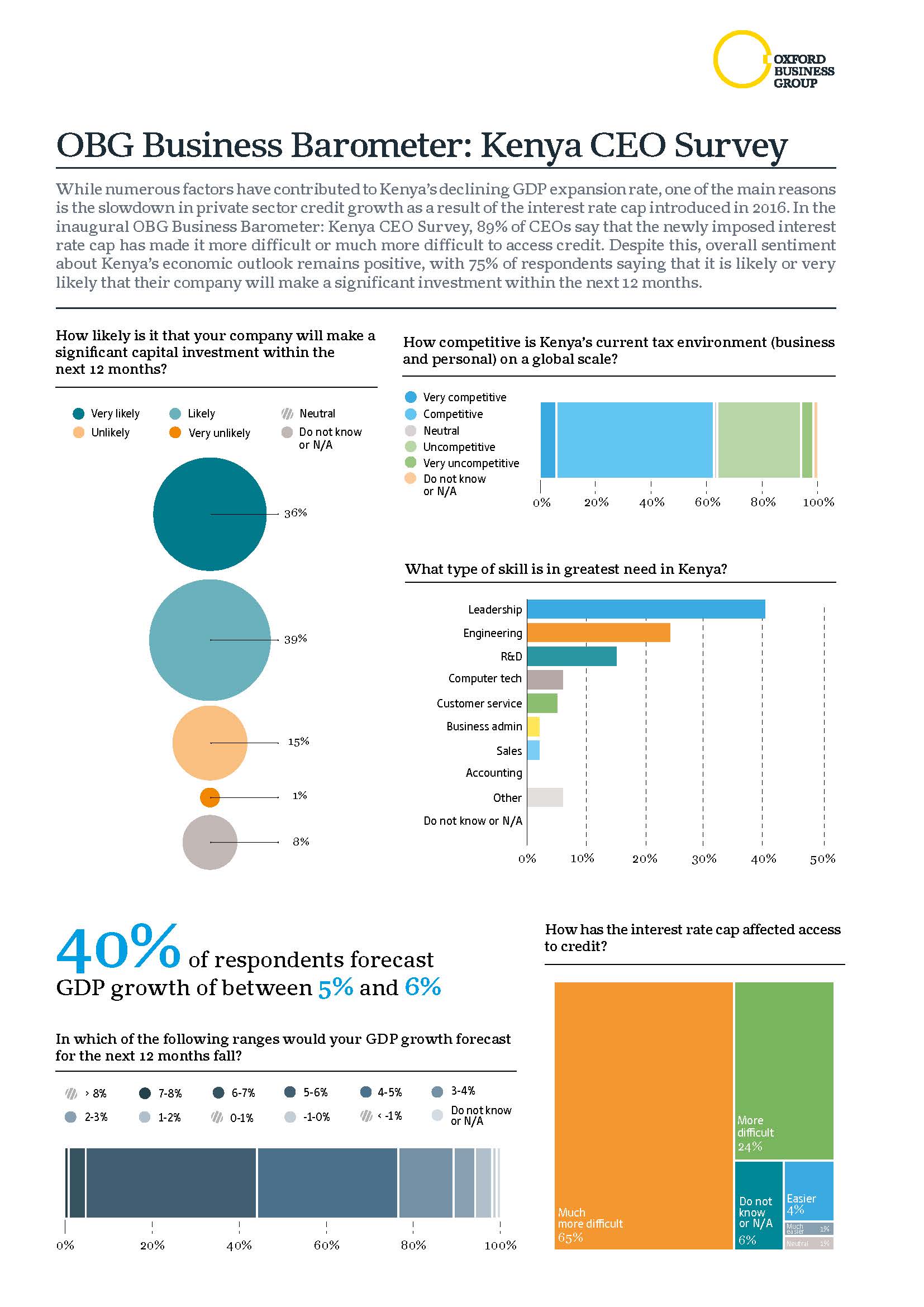

Almost all of the executives interviewed for the survey were bullish about the country’s economic prospects for the coming year, the findings revealed, although most also said that the interest rate cap, introduced in September 2016 to improve the cost of borrowing, had made access to credit more challenging.

From the CEOs interviewed, 95% felt either positive or very positive about local business conditions for the upcoming 12 months. Three-quarters of business leaders also said they thought it likely or very likely that their company would make a significant capital investment within the same timeframe.

However, a sizeable majority (89%) of respondents told OBG that the decision to cap commercial interest rates at four percentage points above the Central Bank of Kenya’s benchmark rate had made borrowing either more difficult or much more difficult.

Commenting on the results, Mzali said that2017 was undoubtedly a challenging year for Kenya, especially its small-scale businesses, many of which have borne the brunt of the tighter risk-management tools implemented by lenders.

“Establishing an enabling environment for Kenya’s private sector and SMEs to grow and carry out their investment and development plans in the years to come will play a crucial role in the success of President Uhuru Kenyatta’s Big Four agenda, which targets four key pillars – manufacturing, affordable housing, health care and food security – over the next five years,” she said.

Anne Kirima Muchoki, chairperson, Keninvest, said that while factors such as the credit squeeze, drought and protracted elections, had combined to keep GDP growth in Kenya below 5% last year, the strong business sentiment evident in OBG’s survey reflected an improving outlook.

“Positive developments in key areas of the economy, including the tourism industry, and significant rainfall in the latter part of 2017, are among the positives noted by both analysts and the business community,” she said.

Mzali’s in-depth evaluation of the survey’s results can be found on OBG’s Editor’s Blog, titled ‘Next Frontier’. All four of OBG’s regional managing editors use the platform to share their expert analysis of the latest developments taking place across the sectors of the 30+ high-growth markets covered by the company’s research.

The OBG Business Barometer: CEO Surveys feature in the Group’s extensive portfolio of research tools. The full results of the survey on Kenya will be made available online and in print. Similar studies are also under way in the other markets in which OBG operates.